Explainer: City College’s Controversial Retiree Healthcare Fund

Ellen Yoshitsugu

In the summer of 2020, City College of San Francisco, like many other institutions, anticipated a serious revenue shortfall caused by the COVID-19 pandemic’s global economic fallout. To bridge the gap, faculty union American Federation of Teachers Local 2121 negotiated a pay cut and college administrators withdrew $21 million from a fund set aside to pay for the health care of future retirees.

Nearly two years later, the college’s oversight agencies claim that this withdrawal was a loan in need of repayment, the fund was depleted and the college’s fiscal management is in question.

The fund is known by the acronym “OPEB,” which stands for Other Post Employment Benefits. It’s an important accounting term for healthcare promised to employees in retirement. It continues to be a point of contention in the ongoing budget debates around the college’s financial future. Over the course of the past three months, this reporter has dug deep into its history, the numbers and interviewed experts to understand what’s going on.

Origin

In 2005, headlines warned that these retiree benefits loomed like a tidal wave of debt over public sector employers like cities and school districts after the Government Accounting Standards Board (GASB) issued a ruling known as Statement 45 that requires government employers to note accumulating future debts as liabilities on each year’s current books. This seemingly small change in accounting practices has had big fiscal consequences for government employers, including City College. With one ruling, many balance sheets across the country went from black to appearing to be in the red.

GASB 45 has pressured employers to pay for retiree healthcare twice each year. Once for former employees who are currently in retirement, and a second time to, step by step, pre-fund healthcare for all future retirees by setting up OPEB trust funds.

“In case something horrible happened to City College, a bomb dropped on it or something, then the [health care] funds would come out of it,” Susana Atwood, CPA, retired UC auditor and City College accounting instructor, said.

Confusing! Imagine two hoses running, one for this years’ bills and the other slowly filling a large bathtub against future disaster.

City College and OPEB

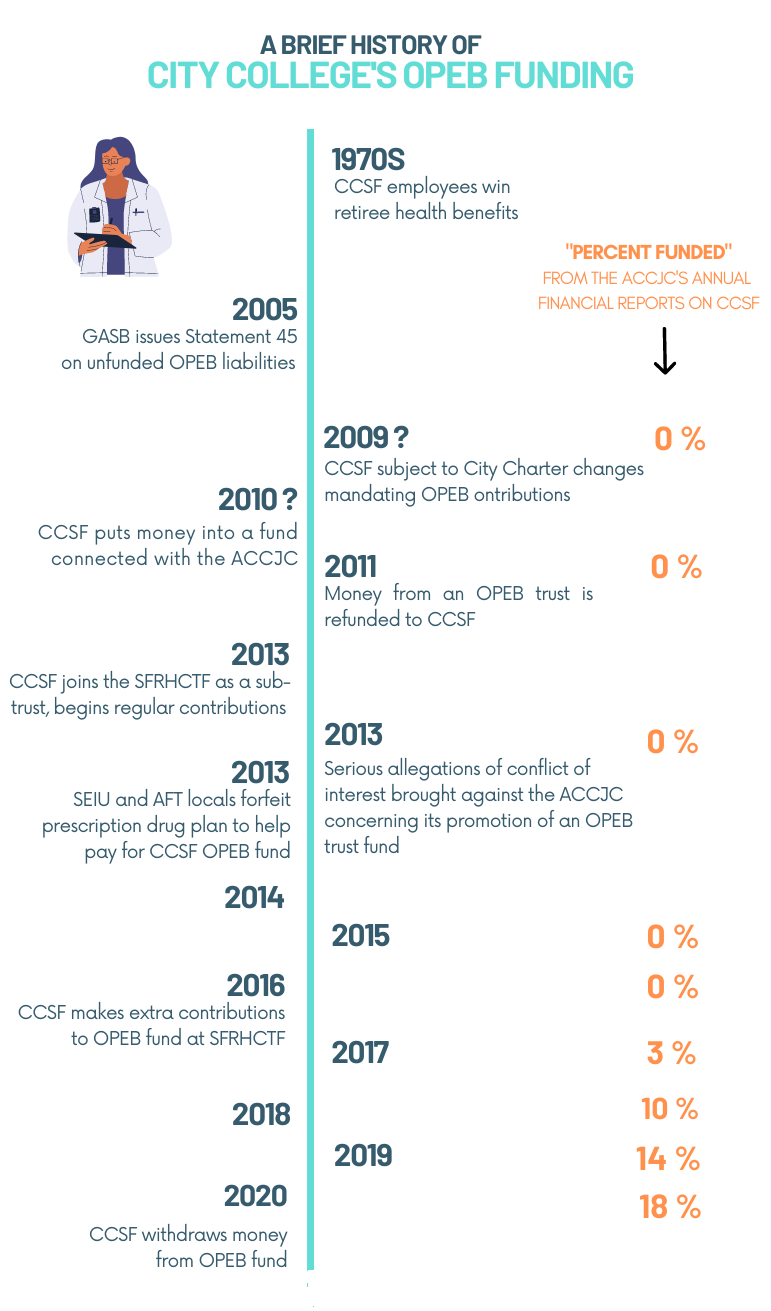

City College’s first attempt at setting up an OPEB trust fund ended when multiple conflicts of interest were discovered between members of the Accrediting Commission for Community and Junior Colleges (ACCJC) and the fund trustees, according to 2013 court documents. The money was refunded to the college in 2011.

In 2013, the college joined the San Francisco Retiree Health Care Trust Fund (SFRHCTF), as a sub-trust alongside city employees such as police and Muni drivers, agreeing that no funds would be withdrawn until 2020, SFRHCTF documents show. Since then, the college has been making its regular contributions, and as the public has learned now, putting in some extra money as well, towards filling the OPEB “bathtub.”

OPEB Withdrawal

In September 2020, the City College Board of Trustees (BOT) put forward two resolutions, one setting restrictions on disbursements from its SFRHCTF sub-trust and one declaring an extraordinary financial circumstance and requesting $21 million to pay for retiree healthcare for FY19/20 and FY20/21. They pledged no further disbursements until the sub-trust is fully funded. There is no mention of a loan or repayment.

In preparation, the college’s actuary determined that the move was fiscally prudent and the college was meeting its obligations to its future retirees. In his response, the actuary noted that since 2016 City College had contributed $16.9 million more into its OPEB trust than required and this had brought in additional investment income of $5.3 million, which together added up to more than the $21 million requested. The RHCTF, on its end, confirmed these extra payments and also approved the withdrawal. Rather than a loan, it was a refund of excess contributions.

City College demonstrated fiscal prudence in two ways. First by setting aside the extra OPEB funds, and second by carefully making sure that withdrawing funds would not harm its ability to meet its obligations to future retirees.

In an April 2021 letter, the Fiscal Crisis Management and Assistance Team (FCMAT) called out City College to the California Community College Chancellor’s Office, alleging that the college has borrowed from its OPEB trust to balance its prior year books and has no plans to repay those funds. She also claims that in doing so the college is “fully depleting its OPEB fund.”

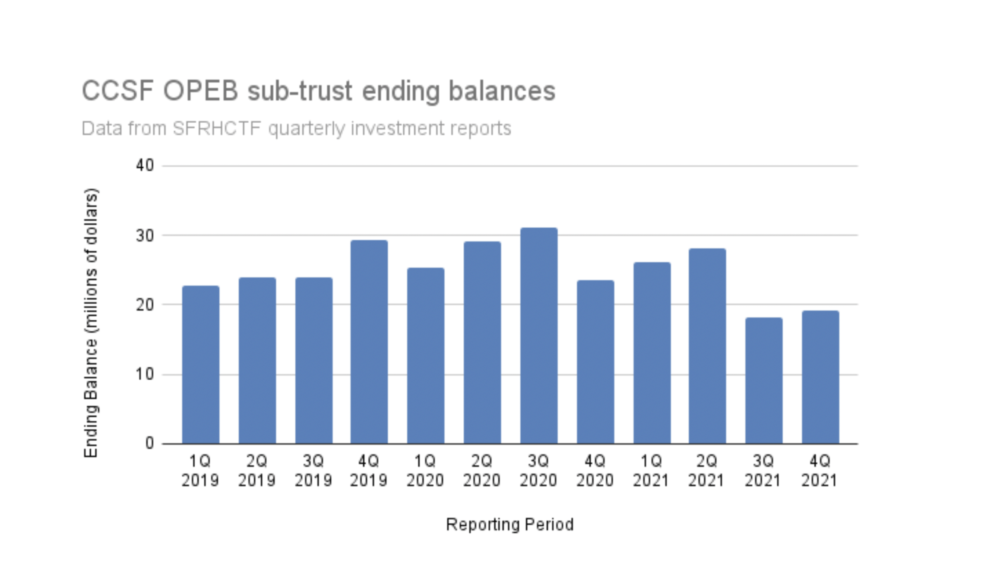

The FCMAT claim is false. This graph of the college’s OPEB sub-trust balances at the end of each quarter for the last three years, based on the RHCTF’s investment reports, clearly shows that at no time was the fund anywhere near “fully depleted.”

At a recent Budget Forum Martin said the college made “a commitment to repay those funds at an accelerated rate if possible.” A recent budget plan shows the college is planning to make extra OPEB contributions in the next two years.

“No unnecessary transfers at the expense of educational opportunity” counters the AFT 2121 in its Alternative Budget, arguing against making non-required OPEB payments at this time.

Atwood says that both Martin and Dr. John al-Amin, vice chancellor of finance and Administration, have admitted during multiple budget conversations that the funds do not need to be repaid.

In October 2021, the ACCJC threatened the college with “future adverse action” in part because its “other post-employment benefits trust is only 18.3% funded.” The “percent funded” is a ratio of the market value of the assets in an institution’s OPEB trust to its “unfunded OPEB Liability” (the bathtub), a measure of how well it is progressing towards its full funding goal. The college only needs to show that it is on track.

The college’s actuary is the one who really knows, and his calculations found that CCSF’s OPEB fund would be fully funded by 2046, 22 years from now, which is in line with other OPEB funds in the city.

In the timeline below, the “percent funded” number, from the ACCJC’s own fiscal reports on City College, is superimposed over a timeline of OPEB related events at the college. Seeing the ACCJC’s values for this measure in the context of the college’s OPEB history reveals a number of serious discrepancies, and calls the validity of the ACCJC’s criticism on that point into question.

‘Fight to Keep Them’

Medicare only covers basic medical expenses for elders and the disabled requiring extra coverage.

Following the civil rights and women’s movements in the 1960’s and 70’s, and a wave of public sector strikes, City College employees won collective bargaining rights in 1975. Regarding healthcare benefits, retired CCSF Labor Studies professor Bill Shields states, “they fought hard for them, negotiated diligently, and once obtained, have fought to keep them.” OPEB contributions are deducted from employee paychecks and in 2013 both the college’s SEIU and AFT locals forfeited their own prescription drug plans to contribute to the OPEB fund.

GASB 45 and related statements have “weaponized retiree health,” according to Shields, similar to how the US Postal Service has been required to prefund retiree benefits 75 years in advance, a requirement recently overturned by the US Congress.

Labor Campaign for Single Payer’s Cindy Young said, “Under a single payer system, health care for all seniors would be included in providing care to everyone, so it would no longer be on the college’s books.”

This article was produced for JOUR 35: Data and Multimedia Journalism Spring 2022 semester with guidance from instructor Alex Mullaney and editing from The Guardsman.

Interesting article! Thorough and well-researched. I will need to read it a few more times to fully understand the complexities!

It’s common knowledge that employer-sponsored retiree healthcare benefits have LONG BEEN all-but-gone in private sector employment, so the REAL question should be ………….. why should PUBLIC Sector workers get a PRIMARILY taxpayer-funded benefit that the vast majority of Taxpayer (who work in the PRIVATE Sector) don’t get?

And, when you finish thinking about that , the SAME thing applies the to VERY VERY generous Defined Benefit pensions near UNIVERSAL in the PUBLIC Sector but near nonexistent today in the PRIVATE Sector.

Private Sector Taxpayers are get VERY tired of being treated as the “sucker”, there to be financially abused.