Higher Education Loan Coalition urges reductions

By Diane Carter

Two members of the House of Representatives working together as a bipartisan team were thinking about you and I and about our student debt issues on Oct. 10.

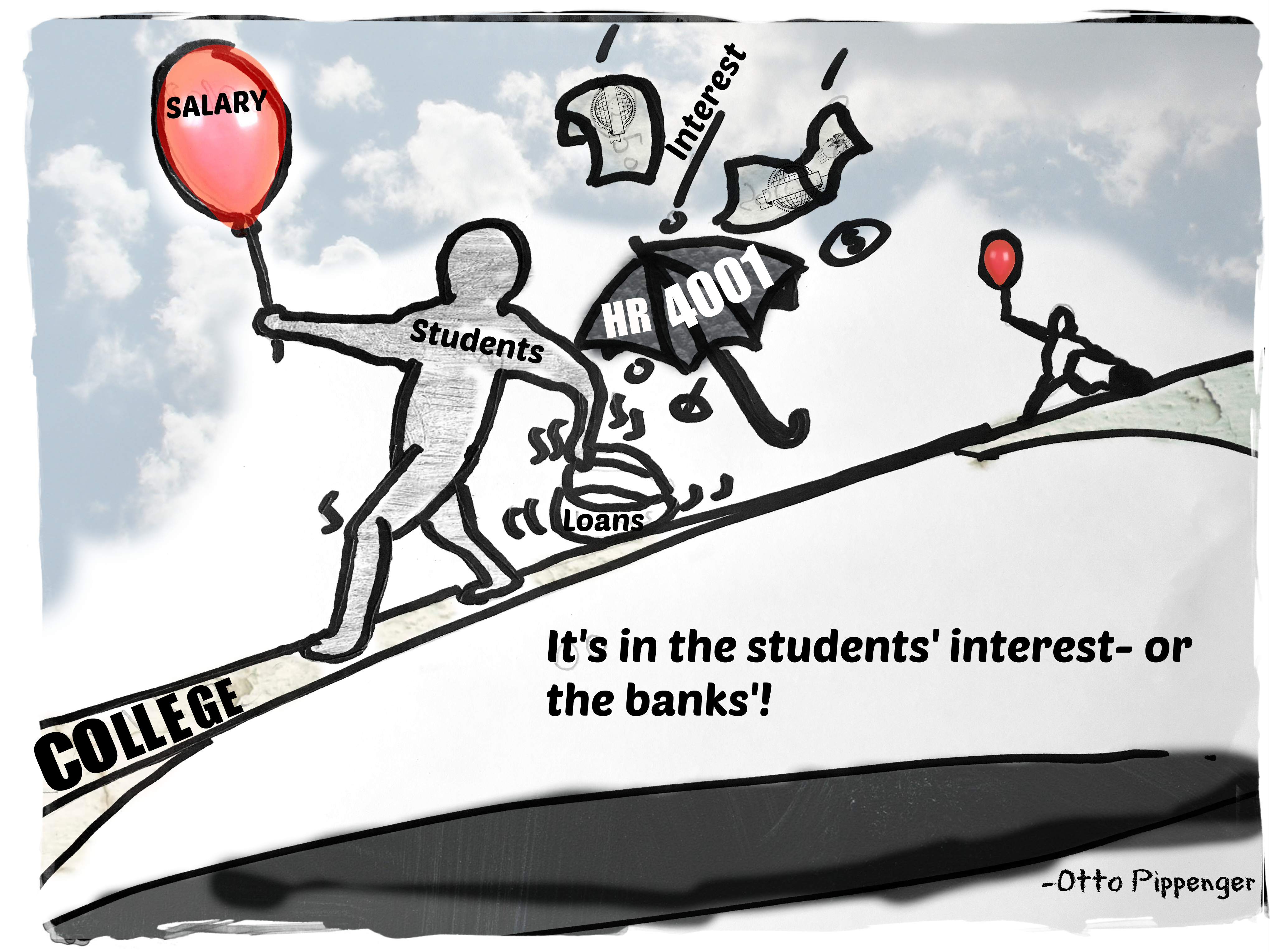

Rep. John Garamendi (D. CA.) and Rep. Brian Fitzpatrick (R PA.) introduced a proposed bill to the House Education and Workforce Committee of the 115th Congress known as H.R. 4001.

The bill is commonly referred to as the “Student Loan Refinancing and Recalculation Act.” It is widely known that of the $1.3 trillion student loan debt carried by American college students, $875 billion of that debt is financed by our government at interest rates that far exceed market rates for most government loans.

Students are charged up to 6.84 percent on the principal they borrow, because the loans which the government makes are unsecured (i.e. without any collateral to guarantee repayment.) Secured government loans that are backed by some form of collateral such as property, bonds, stocks etc. carry interest rates that are lower.

Under H.R. 4001 students would be allowed to refinance their current student loan rates.

If approved, students can apply to have certain education related loans such as Federal Direct Stafford Loans, Unsubsidized Stafford Loans, Federal District PLUS Loans, and Federal Direct Consolidation Loans issued at lower interest rates.

The new rates of interest on the reissued loans will be determined by the 10 year treasury, at the final auction held prior to the first day of the month in which the application for reissuance under this section is received plus 1 percent. Moreover, reissued loan from the categories listed above shall have the new lower interest rate fixed for the period of the loan.

Loans issued under the new conditions, shall have the same principal as the original loan, except as amended by conditions of H.R. 4001.

H.R. 4001 will eliminate origination fees on all of the loans it covers and will delay the accrual of interest on the original principal as long as students are pursuing their education.

Another benefit of this proposed legislation will be that students studying medicine and dentistry will be able to defer payments on their loans until they finish their residency programs.

As the twenty-first century demands advanced educational training at the college level, the bill will help lower and middle income students to post graduation success and will alleviate the stress placed on students studying for a profession, such as becoming an Orthodontist.

It is projected that if the conditions stated in H.R. 4001 are signed into law, the graduates will be able to achieve personal goals like owning a home, starting a family and repaying the principal due, sooner rather than later.

Advocates of H.R. 4001 believe that the bill will establish fair market driven loan terms that will allow graduates to clear heavy debt sooner than they would under the old interest rate.

If H.R. 4001 passes it will alleviate some of the student debt, however, a better way of alleviating the debt would be to fund free education for persons wanting to pursue medical or dental careers. Both fields of endeavor cost too much for the middle income student to pursue. For example, according to the American Association of Orthodontist, the average graduate in in their discipline graduates with $365,000 in student debt. Seeing this is the case, Jean Rash, Chair of the Higher Education Loan Coalition urges all of us to support this new refinancing act. I concur with her opinion. We need to remove the unnecessary interest charged on educational loans backed by our government.