Dueling tax plans claim to save ed funds

By Alexander Schmaus

The Guardsman

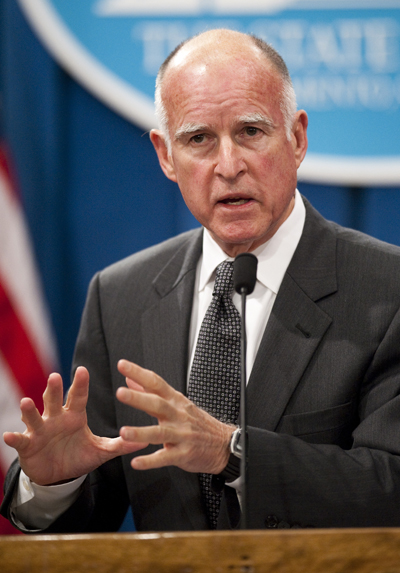

California Governor Jerry Brown proposed heavy budget cuts to public health and welfare in his 2012-13 state budget plan released January 5.

If Brown gets his way the impact will be felt across the state: a $450 million cut to childcare subsidies, a $678 million cut to Medi-Cal, a $168 million cut to in-home supportive services, and a $1 billion cut to CalWORKs.

“These are painful reductions,” Brown said. “These are not nice cuts, but that’s what it takes to balance the budget.”

Brown is seeking to address the other half of the state’s $9-$13 billion deficit with an initiative that asks California voters to support a package of temporary tax increases. The tax package includes a .5% increase in the sales tax and an increase of up to 2% on taxes paid on income above $500,000.

If voters reject his tax proposal in November, Brown threatens more budget cuts. His plan includes $5 billion in “trigger” cuts to education: $4.8 billion from schools, and $400 million from higher education.

The California Federation of Teachers is proposing a progressive alternative called “The Millionaire’s Tax”.

They propose a permanent tax increase of 3% on income between $1-2 million and 5% on income over $2 million. It would raise about $6 billion to begin re-hiring laid-off teachers, rolling back college tuition increases and restoring funding to essential social services.

City College English instructor and American Federation of Teachers Local 2121 President Alisa Messer is confident about the campaign’s prospects. “This is common sense to most Californians, if we are going to raise taxes, they should not be on the 99%, they should be on those that can afford to pay.”

Messer estimates that the initiative would raise about $13 million a year for City College. She hopes City College students, faculty and staff will participate in a grassroots movement of support for “The Millionaire’s Tax.”

A recent poll published by Calbuzz suggests that 70% of California voters are likely support the initiative if it makes it on the ballot in November.

Brown’s tax package, polling at 62%, is less popular.

Comments are closed.